CM Solar

Commodity prices affect the investment costs of solar PV and onshore wind

How do commodity prices affect the investment costs of solar PV and onshore wind?

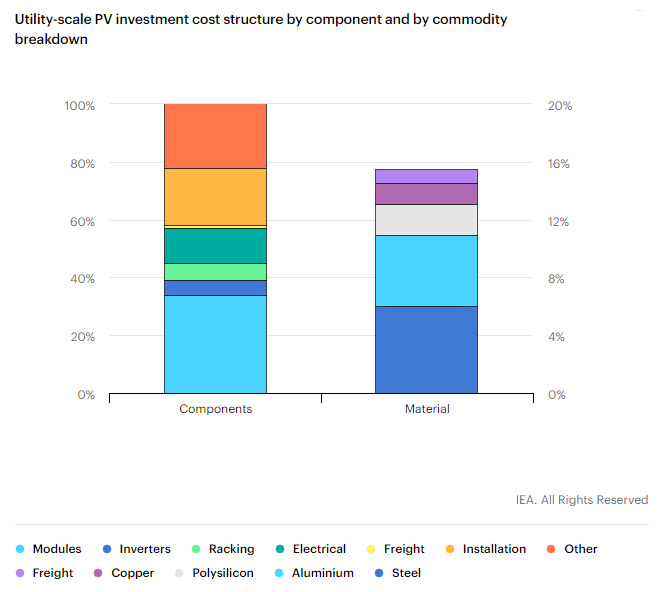

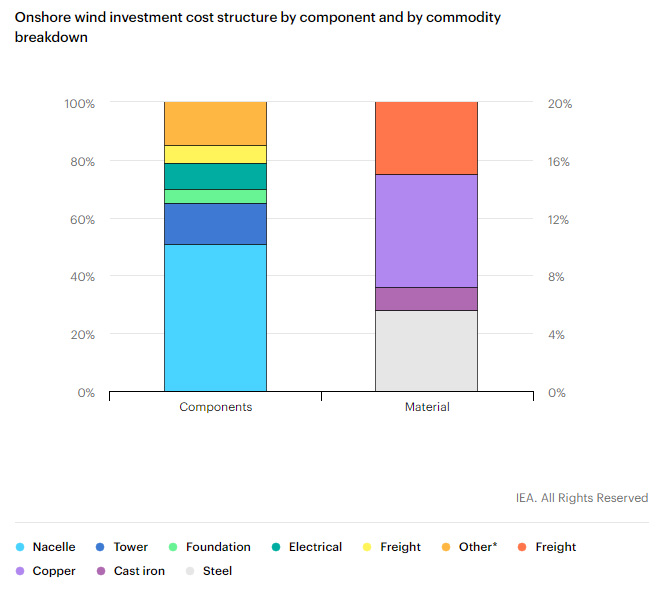

We estimate that key commodities and freight costs make up about 15% of total utility-scale solar PV and onshore wind investment costs. Solar PV’s largest cost component is the manufacturing and shipment of the module, which is directly affected by the price of polysilicon, steel and aluminium. Inverter and electrical installation costs depend on the price of copper, while all components are impacted by increasing freight rates. Steel contributes the most to the final cost of wind installations, as large quantities are used in manufacturing and construction of the tower, nacelle and mechanical equipment. Freight can make up to 6% of total onshore wind investment costs, as the transport of bulky elements with specialised ships is required.

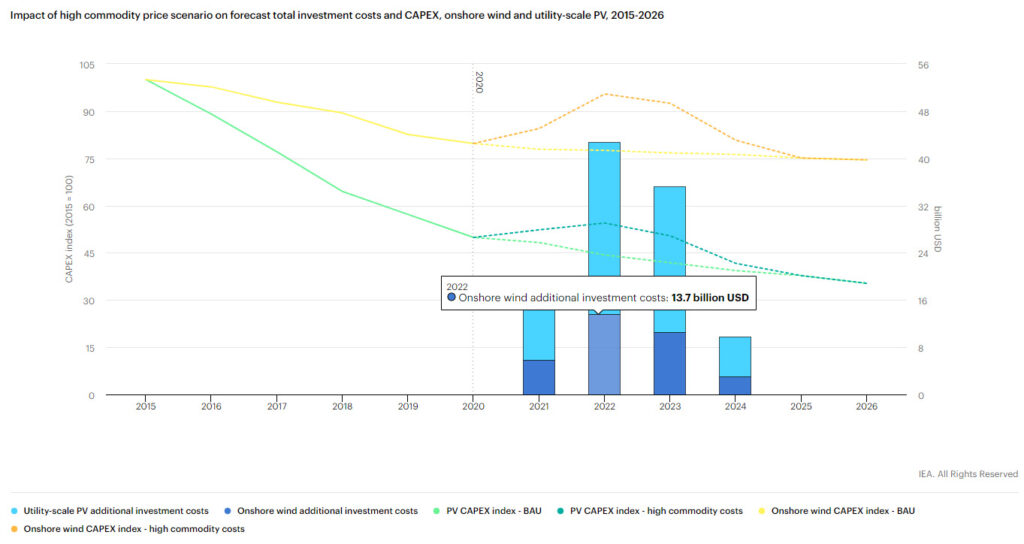

Upfront capital and associated financing costs are 70-80% of the levelised cost of electricity generation for wind and 80-90% for solar PV. Thus, any increase in initial CAPEX greatly affects the profitability of the investment. We estimate that the overall investment cost of utility-scale PV and onshore wind plants could increase by around 25% due to the commodity and freight price surge, based on a comparison of average commodity prices between 2019 and 2021.

Increases in commodity prices do not immediately affect investment costs, as developers, manufacturers and other parts of the supply chain usually maintain stocks of materials and have contracts based on previous prices. However, the increase in raw material and logistics costs ultimately affects the whole value chain and could result in a higher cost of electricity generated at renewable installations. Different areas of the value chain, such as manufacturers, equipment installers and developers, can absorb cost increases in different ways, with some sectors being more affected than others. Additional hedging mechanisms, the sharing of costs or the strategic distribution of equipment are all options developers can use to minimise the impact of increased costs in the short term.

Implications for manufacturers

Higher costs led to decreased equipment purchases in Q1 2021, as numerous manufacturers reported fewer orders because of higher input prices led them to adjusting the price of their finished products. While purchases increased in Q2 as buyers accepted the new market conditions, growing demand coincided with a sharp increase in polysilicon prices. Higher costs have also resulted in wind equipment manufacturers reporting reduced margins, with some lowering their profit guidance by 50%.

In addition, many European and American wind turbine manufacturers have already announced price increases ranging from 10% to 25% for new orders. While manufacturers are reducing freight costs by sourcing equipment from countries closer to their assembly hubs, increased material costs could be felt downstream as manufacturers use hedging clauses to pass commodity price risk on to the buyer. China has not been insulated from rising commodity costs. Even though China produces around 80% of the world’s modules, higher commodity prices have driven solar PV system costs higher in that market. Chinese wind equipment prices, however, have hit record lows in 2021 due to fierce competition among suppliers left with manufacturing overcapacity after exceptionally high deployment in 2020.

Implications for developers

Recent government-led competitive wind and solar PV auctions have already seen contract price increases partly due to high commodity and freight prices. In Brazil rising equipment prices have contributed to awarded prices being over 70% higher in 2021 auctions compared to those held in 2019. Nevertheless, the awarded prices are substantially below those awarded to natural gas-fuelled generation in Brazil’s emergency reserve auction held in October. In India auction prices for solar PV in Q3 2021 were 16% above the historical lows reached in Q4 2020, which may result in delays in signing PPAs with utility companies. The most recent renewables auction in Spain resulted in prices nearly 30% higher than those awarded in January 2021 due, in part, to increases in the cost of materials. These auction prices are, however, well below current wholesale prices in the country. Nascent renewables markets are also seeing higher prices. In Colombia final contract prices for solar PV at the auction held in November 2021 were almost 45% higher than those awarded in 2019, with these increases partially caused by higher investment costs.

Upward price trends for the equipment needed to build solar PV and wind power plants pose a challenge to developers who won bids in competitive auctions anticipating continuous declines in the cost of modules and turbines. The IEA estimates that around 100 GW of awarded but yet-to-be commissioned wind and solar PV capacity from 2019 and 2021 are at risk of the commodity price shock, potentially leading to commissioning delays. A prolonged increase in commodity and equipment prices could result in developers withholding equipment purchases until prices return to lower levels. Meanwhile, auction organisers, utilities and companies purchasing renewable electricity could also be reluctant to accept higher tariffs, delaying their procurement plans, especially in emerging and developing markets.

Implications for onshore wind and solar PV investment globally

Despite rising costs and contract prices, wind and solar PV generation costs remain lower than fossil fuel alternatives, especially given current high natural gas and coal prices. However, if the prices of polysilicon, steel, aluminium, copper and freight remain at their current elevated levels throughout 2022 and manufacturers continue to increase equipment prices, as currently observed, global investment costs of wind and solar PV could increase further. This situation would erase almost three years of investment cost reductions for solar PV and five years for onshore wind. When compared with previous cost reduction trends, higher commodity and logistics costs could lead to investment costs increasing by USD 70 billion for solar PV and USD 35 billion for onshore wind over the forecast period, affecting the pace of deployment. Without these price increases, developers could build about 95 GW of additional solar PV and 25 GW of further wind capacity over 2021-2026.